COVID-19 Testing & Mitigation Program

*As of January 1, 2023, closeout reporting is now available on rhccovidreporting.com! Please review the video walkthrough here, and complete your submissions by January 31, 2023. If you need to return any funds, please do so by March 2, 2023 by following the instructions here. Once you have completed all steps on your “Closeout To-Do Chart” and have returned any funds if necessary, you have completed all reporting requirements. Please remember to keep record of all cost documentation internal to your organization in case of a future audit. No cost documentation must be submitted to HRSA.*

In 2021, RHCs received $100,000 per clinic as part of the RHC COVID-19 Testing and Mitigation (RHCCTM) Program. This funding was able to be spent between January 1, 2021 and December 31, 2022.

Monthly COVID-19 testing data and quarterly survey questions must have been submitted on RHCcovidreporting.com through December 31, 2022. You were not required to perform testing; however, you still must have reported your data, even if it was 0. You were not required to upload receipts or otherwise demonstrate how you utilized the funding; however, these records must be adequately maintained as your organization may be audited. Additionally, if your organization expended $750,000 or more in annual awards you must obtain a Single Audit.

As a reminder, RHCCTM is a separate program from the RHC COVID-19 Testing Program (RHCCT) that automatically allocated $49,461.42 per eligible CMS-certified RHC for COVID-19 testing expenses. This program concluded at the end of 2021, but RHCs that received CTM money utilized the same portal account ( RHCcovidreporting.com) for both CT and CTM reporting.

See below for NARHC FAQs on the program and other resources. Please contact RHCcovidreporting@narhc.org with any questions!

HRSA Terms and Conditions

RHCcovidreporting.com

Webinars

Allowable Expenses

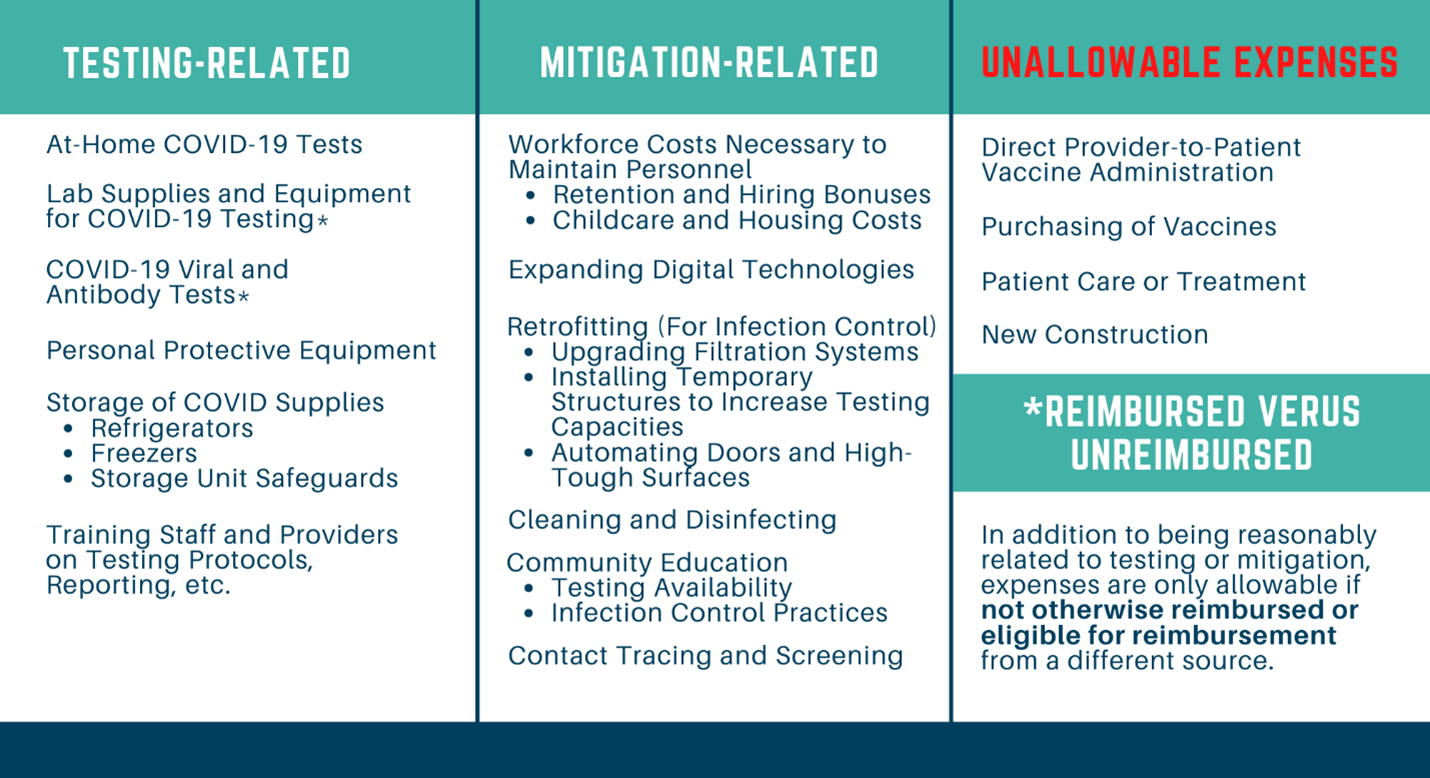

The following table lists some allowable and unallowable uses of the RHC COVID-19 Testing and Mitigation Funding. These lists are not exhaustive, with any questions please email RHCcovidreporting@narhc.org.

COVID-19 Testing & Mitigation Program FAQs

NARHC has hosted several webinars on the RHC COVID-19 Testing Program and Testing and Mitigation Program, available here.

Please visit https://www.hrsa.gov/coronavirus/rural-health-clinics/testing for the official RHCCTM Terms and Conditions as well as official HRSA language and resources. These responses are solely those of NARHC as we strive to best assist you in properly using your RHCCTM funding.

Does RHCCTM funding need to be spent directly at each RHC, or can it be combined, used at the hospital, or used unevenly?

Because RHCCTM funding is allocated at the TIN level, the TIN entity has discretion over the allocation of those funds amongst each RHC. However, it is important to remember that this funding is intended to serve the Rural Health Clinics and their service areas!

How do I attest to the Terms and Conditions and accept or reject the funding?

-

You will attest to the Terms and Conditions and indicate your acceptance or rejection of the funding here.

-

You will then return the funding here.

How must I report on the RHCCTM funding and what do I need to report?

Reporting for this program, like for the RHC COVID-19 Testing Program, must be done through rhccovidreporting.com. Total tests performed and total positive tests at the TIN entity level (not each RHC) must be reported MONTHLY. You are not required to perform testing; however, you still must report your data, even if it is 0. You are not required to upload receipts or otherwise demonstrate how you utilized the funding; however, these records must be adequately maintained as your organization may be audited. Additionally, if your organization expended $750,000 or more in annual awards you must obtain a Single Audit. Note: this reporting is different than reporting required for the Provider Relief Fund, more details on this can be found here.

What "education" is considered an allowable expense?

RHCCTM funding can be used for community education on topics such as: healthy operations, preparing for when someone gets sick, testing promotion and confidence building, quarantine, isolation, when you can be around others, and post-COVID conditions. It also can be used to promote healthy behaviors that prevent the spread of COVID-19. Partial salary of care coordinators and educators of COVID-19 testing and mitigation efforts are permissible.

This may also include marketing components if you educate your patients on COVID testing, mitigation, etc. through newspaper advertisements/articles, for example.

What are some ways I can retrofit my facility to better mitigate COVID-19?

RHCCTM funding can be used to maintain healthy environments or better perform testing in ways such as: modifying layouts to promote social distancing, installing physical barriers and guides to support social distancing, replacing carpeting and upholstered furniture, installing touchless bathroom facilities, doors, and temperature screening equipment, replacing HVAC systems, constructing temporary structures, leasing property, or otherwise retrofitting as necessary to support testing and mitigation.

Can we purchase a mobile clinic or vehicle to reach extremely rural patients?

Yes! A mobile clinic or other vehicle may allow you to provide education, expand testing or screening reach, or better serve post-COVID patients as well as lowering the risk of disease spread by better separating patients. Please note that direct vaccine administration or other patient care are not allowable expenses under the RHCCTM program. Therefore, we recommend only using a portion of funds to purchase a mobile clinic/vehicle, in accordance with the percent of time the unit is used for education and other allowable expense activities.

Can we purchase generators?

Yes.

What types of workforce expenses are allowable?

-

Cleaning Services - Yes, expenses to ensure that additional cleaning requirements and standards to mitigate the spread of COVID-19 are met would be considered allowable expenses.

-

Retention of Salary for Employees with COVID-19 Who Cannot Work - Yes, as long as it is not otherwise reimbursed through disability insurance, worker's compensation, etc.

-

Hiring Bonuses or Partial Salary of COVID-19 Screeners, Nurse Managers, etc. - Yes.

The only limit to retention bonuses is that the funds cannot be used to pay the salary of an individual at a rate in excess of Executive Level II ($203,700). All retention payments must be directly and reasonably related to the provision of COVID-19 testing and mitigation activities.

What types of technology related expenses are allowable?

-

Text messaging system to communicate with patients regarding testing, mitigation, infection control practices, etc.

-

Online scheduling software allowing patients to sign up for a COVID-19 testing appointment.

-

Other digital technologies to strengthen your capacity to support the public health response to COVID-19; telehealth technology, etc.

What types of post-COVID-19 patient expenses are allowable that aren't otherwise reimbursable patient care?

-

Partial salary of a care coordinator to manage post-COVID conditions, coordinate appointments, support groups, resources, etc.

-

Software for chronic care management program for patients facing post-COVID symptoms.

-

Otherwise unreimbursed support services.

What other types of expenses are allowable?

Expenses can be indirect or direct but must be reasonably related to the provision of COVID-19 testing or COVID-19 mitigation activities. Overhead expenses related to COVID-19 testing and mitigation activities are permissible expenses. Expenses related to COVID-19 testing that are not otherwise reimbursed or eligible for reimbursement are also permitted. You may not claim lost revenue under this program.